Overfocusing on sales growth?

By Jack Brumby

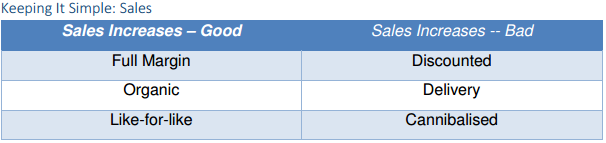

What gets measured, gets done. Sales & margin need managing together:

Summary:

There’s no Holy Grail. Sales & margin need to be considered together. Capex needs to be rationed and, at the end of the day, it’s cash that matters…

Getting the balance right:

• There’s no single killer measure, don’t behave as though there is

• LfL sales growth implies increase at the unit level

• Whilst total sales growth is what turns up in terms of cash

• And margin matters as giving away a tenner for nine quid has always been easy

• Ultimately, ultimately, it’s free cash flow per share that drives value

LfL sales growth; the Holy Grail?

• This is the area of most focus. And it’s nice to be in growth at the unit level

• But it’s not sufficient to live happily ever after. Nor is it even necessarily necessary…

• Because total sales (x margin – expenses) matter re cash flow

• Co A could have positive LfLs but be shutting shops & have declining margins

• Co B meanwhile could have minus 1% LfLs but be adding stores & widening margins

• But slavishly jacking margins can also end in disaster. Ask Restaurant Group

LfL sales, the major weaknesses:

• LfL sales ignore margins (discounting, delivery, marketing etc.) as well as capex & store closures

• They drive certain actions. Sales managers may beggar their neighbours (in the firm) to hit target

• What gets measured, gets done. Paying footballers to get corners will lead to more corners.

• But corners don’t win matches. Goals are what matter

So what?

• Langton has banned the word ‘holistic’. So let’s just say you need a rounded approach

• We’ve banned the phrase ‘balanced scorecard’ too

• But if it was your business, yes, yours, what would you look for?

• You’d look for cash. Free cash. Geld after costs. Everything else is incidental.

• We go into more depth on this and other topics in our review, which is found here