JDW versus RTN. Ten year tussle but I think we have a winner…

JD Wetherspoon & Restaurant Group; contrasting styles…

Background:

- In 2013, 14 & 15 we ran side-by-side pieces comparing JDW w. RTN.

- Whilst the companies were broadly the same size, we much preferred JDW

- RTN had lower sales but higher margins

- Whilst JDW ‘invested’ its lost margin in staff, product and premises & had more freeholds

- RTN was perhaps lean on cost & its prices were top quartile. JDW, well, wasn’t.

- Critically RTN was arguably run by accountants whilst the JDW boss is a pubs nutter

- This is critically important in determining culture & focus on short vs long term prospects

Recent events:

- JDW’s margins have remained under (self-imposed) pressure but trading is stable

- RTN, on the other hand, has managed three profit warnings in little more than four months

- It is changing its CEO, CFO and chairman in little more than a year

- Investors have a queasy feeling that its past is not an accurate guide to its future

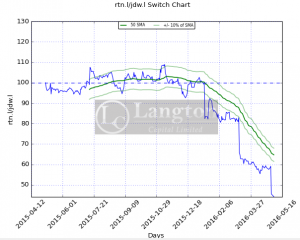

- The RTN/JDW switch chart has an unpleasant, falling-out-of bed feel to it

Where to now?

- Might RTN get bid for? Yes – but what could a penny-pinching PE house bring to the party?

- Is JDW a better prospect at ‘twice the price’? In our opinion, yes.

- So would we switch back? We prefer pubs nutters with a 20yr view so, well, no.